The volatility Bitcoin experienced this week had a particularly interesting impact on the derivatives market. Between June 23 and June 27, BTC lost its relatively stable support at above $64,000 and dropped to $60,000, with a brief dip below $60,000 before recovering on June 25.

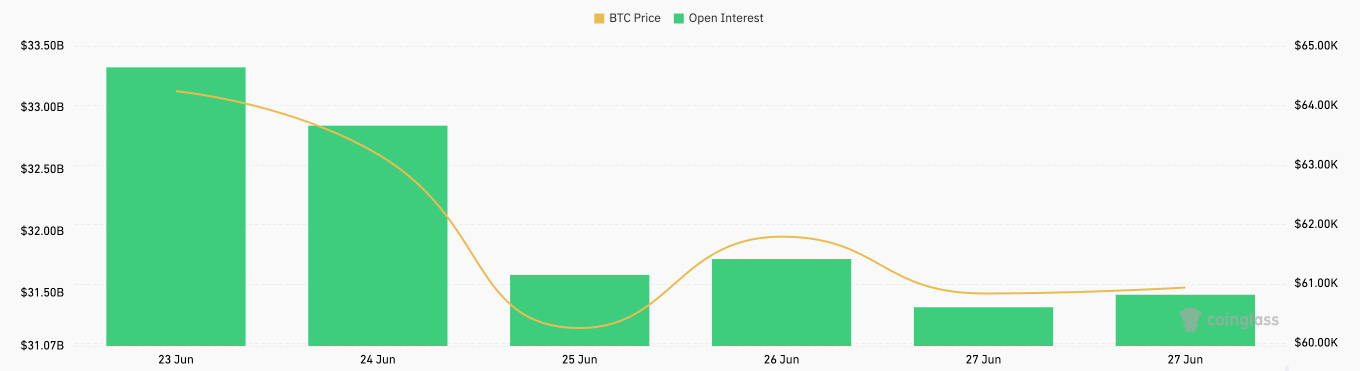

While the price drop might not seem that significant when looking at long-term price action, a drop below $60,000 is an important psychological milestone for traders. This is why the 6% drop had a notable impact on derivatives. Open interest in Bitcoin futures dropped from $33.33 billion on June 23 to $31.39 billion on June 27, reaching its lowest point since May 17.

The primary reason for this decrease was forced liquidations. As the price fell sharply, a significant number of traders with leveraged long positions likely faced margin calls. Unable to meet these calls in time, their positions were liquidated, which could have added to the selling pressure and led to a further drop in open interest.

This often creates a feedback loop, exacerbating the price decline as liquidations trigger additional sell-offs. Furthermore, the declining price likely prompted traders to become more risk-averse. With heightened volatility and uncertainty, traders might have been discouraged from opening new futures contracts, opting instead to reduce exposure until the market stabilizes.

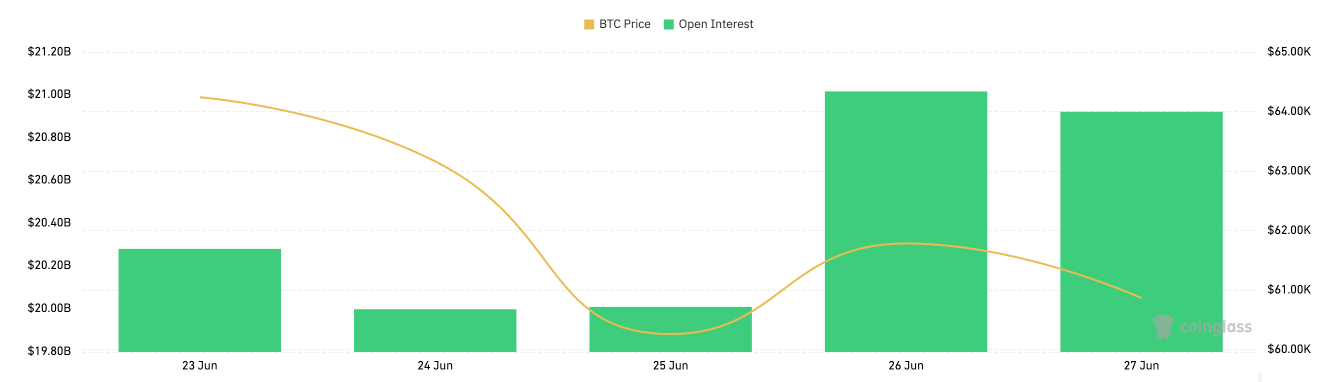

While the futures market contracted, the options market grew. Open interest in Bitcoin options increased from $20.28 billion on June 23 to $21 billion on June 26, despite a brief dip to $20 billion on June 25.

The increase in options OI during this period suggests that traders turned to options as a hedge against potential price volatility. Options are a flexible tool for managing risk, allowing traders to protect their positions and speculate on price movements without the same risk associated with futures. The rise in OI, particularly in a period of price decline, shows that traders were looking to mitigate risk and position themselves for more volatility.

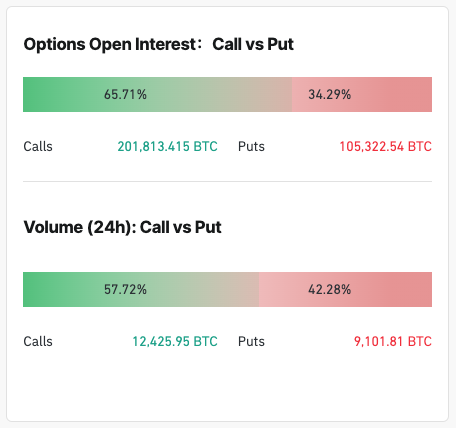

CoinGlass data shows that most traders are preparing for upward volatility. As of June 27, 65.71% of the options open interest consisted of call options, with the 24-hour volume favoring calls at 57.72%. The clear dominance of call options shows a bullish sentiment prevailing, and traders are positioning for price recovery or looking to capitalize on lower prices with limited downside risk.

Arbitrage opportunities between spot, futures, and options markets could have increased options trading activity. Institutional involvement, with institutions using options for risk management and portfolio adjustments, likely contributed to higher options open interest.

Volatility trading, where traders profit from expected changes in market volatility, also attracted more activity in the options market during this period of increased price swings.

The shifts seen in futures and options open interest show how traders employ different risk management strategies in response to price declines. Futures traders appear to have reduced their exposure due to liquidations and increased risk aversion, while options traders increased their exposure for hedging and speculation.

The post Bitcoin volatility sees futures slump, while options open interest spikes appeared first on CryptoSlate.